Week of Dec 31st, Nasdaq & Feeder Cattle, Wishing all a Prosperous Year of 2007 !

Click to enlarge

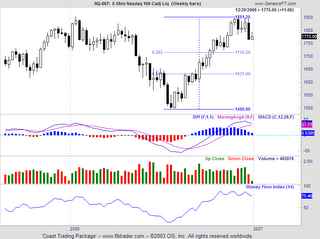

Stock Index Corner: Nasdaq 100

The Weekly Nasdaq 100 is the weakest of all major indices in the US. The last two weeks of divergence of Nasdaq with S&P 500 is seen to be continuing., possibily into the new year.

The first possible support if Nasdaq were to correct further would be the 1715 on the Mar futures, the 0.618 retracement between the recent major hugh and previous major low in July.

S&P500:

Big Picture: (monthly): Bullish (but need to watch for the weekly trend)

Medium term (weekly): Sideway to Bearish

Short term (daily): Sideway to Bearish

Fundamental:

The S&P 500 index continues to consolidate near the top of the July-Dec rally, which took the market to a new 6-year high. Bullish factors continue to include (1) steady US GDP growth, (2) active M&A activity, (3) subdued crude oil prices, (4) optimism about lower US interest rates through 2007, and (5) reasonable valuation levels despite the July-Dec rally in stock prices. Despite the recent favorable news, US stock market investors are still worried about how earnings will hold up in 2007 with weaker GDP growth and how consumers will fare in 2007 with continued high gasoline prices, higher utility bills, and high debt levels. The US holiday

shopping season was on the weaker side of expectations at about +2.0% versus +5.2% growth in 2005. However, the market is looking for decent consumer spending in January.

Major World Indexes

Medium term trend: FTSE (Down), Nikkei (UP, watch out for possible reversal this week), ASX (UP)

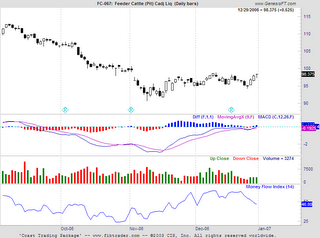

Commodity Corner: Feeder Cattle

Technical:

The feeder cattle has moved sideways for the past several weeks and the last two days actions may provide further upside momentum. The commercials are also at the extreme net long positions.

Fundamental:

CATTLE—Feb live cattle prices in the past week rallied sharply to post a new 2-month high. The main bullish factor was the new snow storm moving across the plains which will disrupt cattle supply movement and reduce cattle weights. However, cattle futures prices continue to see pressure from the difficulty of restarting US beef exports to South Korea due to the hyper-sensitive bone chip testing. The Nov Cold Storage report (released Dec 21) was bearish

since it showed that total beef in storage rose to +17.1% yr/yr from +8.3% yr/yr in Oct. The market monthly cattle on feed report released on Dec 22 was mixed with cattle-on-feed falling to 102% of the year-earlier level from Nov’s 104%, but with cattle placed on feed in Nov improving to 92% from 87% and with Nov marketings rising to 106% from 101%.

Trading ideas : (please do your own research and apply your profit/ risk management rules in all trades, please note except options writing, all the other trades may last just several days)

Writing Options: Feeder Cattle OTM puts

Futures: Long Corn

Stocks: China Telecom CHL, Systemax, Syx