Week of Dec 23rd, S&P 500 & Chicago Wheat, Wishing all a Merry Christmas !

Click to enlarge

Stock Index Corner: S&P 500

Last week, the S&P has shown a weekly reversal pattern and the previous week analysis of potential correction was coming true for both S&P and Nasdaq 100 due to the divergence ie Nasdaq is making lower highs but S&P was making new highs which do not bode well for the markets.

The S&P has also hit the uptrend resistance channel and untl that is broken, the overall picture remains bearish. The MACD has also displayed weaknesses in upward momentum.

In looking forward, it will be a better risk/reward strategy in taking a bearish stand for the indexes and also the US stocks.

S&P500:

Big Picture: (monthly): Bullish (need to watch for the weekly trend)

Medium term (weekly): Sideway to Bearish

Short term (daily): Sideway to Bearish

Fundamental:

Earnings expectations were little changed in the latest week according to Thomson First Call: Q3 (+19.0%), Q4 (9.4%), Q1 (+9.0%), and Q2 (+6.5%). Annual earnings expectations are currently at +15.1% for 2006 and +9.5% for 2007, which would follow 3 consecutive years of double-digit earnings growth (2005 +13.7%, 2004 +20.2%, 2003 +18.4%, vs 25-yr avg of +8.6%). The S&P 500 forward P/E (based on forward-looking earnings) is currently at 16.1

which is mildly below the 3-year average of 16.6 and well below the 10-year average of 19.8, thus keeping the stock market in a fairly reasonable valuation light.

Major World Indexes

Medium term trend: FTSE (Down), Nikkei (UP), ASX (UP)

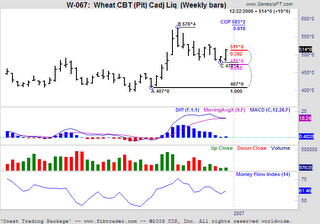

Commodity Corner: Chicago Wheat

Technical:

The daily and weekly of Wheat has shown high chance of possible uptrend for the next 1-2 weeks. If 576 is broken, it will likely attempt to try the next resistance COP at 583.

Fundamental:

Wheat prices have rallied to a new 2-week high on some technical short-covering but remain in the lower half of the 2-month consolidation range that has developed below the 10-year high posted in Oct. The fundamental backdrop remains bullish due to this year’s much smaller global wheat crop due to drought in Australia, heat in Europe, and drought/heat in the US. However, US wheat exports are running -20% yr/yr due to high US wheat prices.

Trading ideas : (please do your own research and apply your profit/ risk management rules in all trades, please note except options writing, all the other trades may last just several days)

Writing Options: Wheat OTM puts

Futures: Long Wheat CBT

Stock Options: Long CSCO Puts, Long Goog Puts