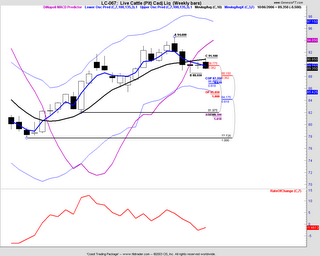

Week of Oct 8th, Live Cattle & Nikkei 225

click to enlarge

Stock Index Corner: Nikkei 225

The Nikkei is playing catching up with the S&P500, and the technical strength is showing more upside potential. Next targets: 16710 & 17490 (Dec futures)

S&P500:

Big Picture: (monthly): Bullish

Medium term (weekly): Sideways to Bullish

Short term (daily): Possible move to the down side for the next several days

Do note that next few weeks of US corporate earnings annoucement may increase volatility of the markets.

Major World Indexes

Weekly MACD Histogram (Medium term): FTSE, Nikkei, ASX - UP (Bullish)

Commodity Corner: Live Cattle

Fundamental (source: CRB):

CATTLE—Oct live cattle prices continue to consolidate in the

lower half of the early-Sep sell-off, which was prompted mainly by

seasonally weak demand and technical long liquidation pressure

(after the extended 30% rally seen since May). The market is

watching for progress on getting US beef shipments going to South

Korea, after South Korea announced on Sep 8 that it would end its

3-year ban on US beef. Japan dropped its ban on US beef this past

summer and shipments to Japan are off to a good start. The Sep 22

Cattle on Feed report was bearish with Aug cattle placements rising

to 137% of the year-earlier from 117% in July. The Sep 1 cattle on

feed number was 110% of the year-earlier level, up from 107% on

Aug 1.

Technical:

The weekly of Live cattle is showng weakness and possible down moves in the next 1-2 weeks.

Possible downside target: 87 (Dec futures)

Trading ideas : (please do your own research and apply your profit/ risk management rules in all trades, please note except options writing, all the other trades may last just several days)

Writing Options: Soy Meal OTM puts

Futures: Short TBond

Stock Options: Google (long calls), OMX (long calls)