Week of Nov 26th, Nikkei 225 & USD Index

Click to enlarge

Stock Index Corner: Nikkei 225

Both the weekly and monthly of Nikkei are pointing to the possibilities of more decline ahead. The next support would be 15120 and then 14720 if broken.

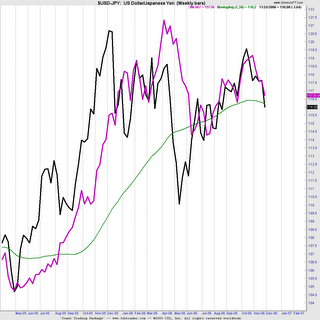

Do take a closer look the chart of Nikkei's correlation with USD-JPY currencies movement. Since end of 2004, these two markets has seen a close correlation. The strengtening of Yen or weakening of USD may hurt the exporters driven economy of Japan, thus dampening the Japanese stocks.

Do watch closely the movement of USD-JPY to anticipate the future trend of Nikkei.

S&P500:

Big Picture: (monthly): Bullish

Medium term (weekly): Sideway to Bullish

Short term (daily): Sideway to Bullish

Fundamental:

Earnings expectations were mixed in the latest week according to Thomson First Call: Q3 (+18.9% vs 19.0% in the prior week), Q4 (+9.6% vs 9.8%), Q1 (unch at +9.0%), and Q2 (+6.5% vs 6.9%). Annual earnings expectations are currently at +15.0% for 2006 and +9.4% for 2007, which would follow 3 consecutive years of double- digit earnings growth (2005 +13.7%, 2004 +20.2%, 2003+18.4%, vs 25-yr avg of +8.6%).

Major World Indexes

Medium term: FTSE, Nikkei, ASX - Down (bearish).....Nikkei is the weakest index at this junture.

Commodity Corner: USD Index

Technical:

The technical pictur eof USD index looks set to decline further. Next support would be 82.07 and 80.39 if prior support is broken.

Fundamental:

The dollar/yen has fallen to a new 2-month low and euro/dollar has rallied to a new 6-month high. The dollar has been undercut by the recent weak US economic data (consumer confidence, housing starts), concerns that the Chinese central bank may step up its dollar reserve diversification program, underlying concerns about the continued massive US trade deficit and the outflow of dollars from the US, and technical weakness. US interest rates remain well above European and Japanese rates, but US interest rates are pointed lower while European and Japanese rates are pointed higher. The market is still unanimously expecting the European Central Bank to raise its refi rate by 25 bp to 3.50% at its next meeting on Dec 7 and to raise the refi rate by another 25 bp rate hike to 3.75% by March 2007. The market is discounting a chance of a BOJ rate hike by the end of 2006 but is fully discounting

that rate hike by the end of Q1.

Trading ideas : (please do your own research and apply your profit/ risk management rules in all trades, please note except options writing, all the other trades may last just several days)

Writing Options: USD OTM Calls

Futures: Long Lumber

Stock Options: Long Qcom calls, Long ATI calls