Week of Oct 29th, Dow & Cotton

Click to enlarge

Stock Index Corner: Dow Jones Industrial

The daily of Dow Jones is a a few points away from Fib OP target....The daily may correct to first support level of 11737 (not shown).

S&P500:

Big Picture: (monthly): Bullish

Medium term (weekly): Sideways to Bullish

Short term (daily): Sideways to Bearish

Fundamental:

The earnings calendar remains very busy this coming week (Oct 30 to Nov 3) with 83 of the S&P 500 companies due to report, following last week’s peak of 155 companies. Changes for earnings expectations were mixed in the latest week: Q3 (+15.9% vs +13.9), Q4 (+11.4% vs +11.7%), and Q1-2007 (+8.8% unch wk/wk), and Q2 +6.7% vs +6.4%), according to Thomson First Call. Annual earnings expectations are currently at +14.5% for 2006 and +9.7%

for 2007, which would follow 3 consecutive years of double-digit earnings growth (2005 +13.7%, 2004 +20.2%, 2003 +18.4%, vs 25- yr avg of +8.6%).

Major World Indexes

Weekly MACD Histogram (Medium term): FTSE, Nikkei, ASX - UP (Bullish) , do watch closely the influence of S&P500 and the Nasdaq's directions over next several weeks...

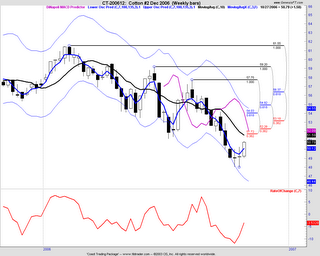

Commodity Corner: Cotton Dec

Technical:

The daily Cotton has found an bottom and possibily moving up for the next several days. Next resistance: 52-53

Fundamental:

Dec cotton has rebounded mildly higher in the past week, finally showing some spillover strength from beans and grains. Cotton continues to be depressed by weak export demand

and by hedge pressure from the incoming crop. Cotton prices are weak despite this year’s sharp -13.5% yr/yr drop in the crop size and -17% yr/yr drop in US carry-over. Cotton is 44% harvested, 1 point ahead of the 5-yr avg of 43%.

Trading ideas : (please do your own research and apply your profit/ risk management rules in all trades, please note except options writing, all the other trades may last just several days)

Writing Options: Cotton OTM Puts

Futures: Long Cotton (dec)

Stock Options: CSCO (long puts), Teva (long puts)