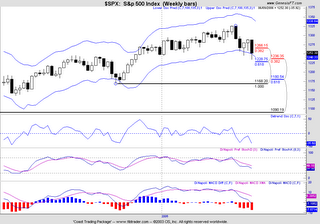

Week of June 11th

(pls click the above image to enlarge...S&P500...)

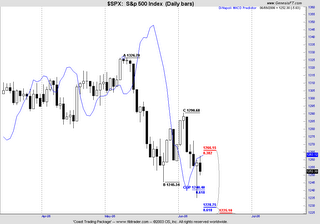

S&P500: This week in wall street/ global markets had been been one of the most exciting week and truly challenged the wits of technicians ..! The various key support levels were tested last thursday in S&P, had an uncofirmed "wash & rinse", and had touched weekly key fibonnaci support... at 1252.

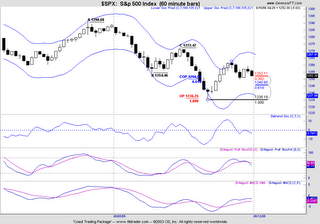

The friday's actions show possible uptrend going to next week...(look at S&P 60 mins chart, retracing to 0.382 level of the recent intraday high to the low..macd pointing higher)

FTSE remained above uptrend line, ASX and Nikkei are the weakest of the major indices.

Big Picture: Medium Term has not changed...still bearish..

Medium term: Position to sell short on stock rallies..at key fibnode levels.

Short term: Possible short term uptrend next week..

Technicals: S&P500, FTSE, ASX, Nikkei: Weekly MACD Histogram - Down (bearish)

Trading ideas (June 12-16th):

(please apply your risk management rules in all trades)

Rolling Options: Sell puts on Tbonds (Sep, 103-104)

Futures:

Long Sugar (near key fib support level), Short Lean Hog, Short Live Cattle (near Fib resistance)

Stocks: Possible short term (2-3 days) long Call play, mrvl, slb, bhp

Comments are welcome....!