Week of Sep 18th, FTSE100 & Tbond

click to enlarge

Stock Index Corner: FTSE100

The London FTSE has indicated more bearish bias than other major indexes. This was due to the sluggishness and bearish tone of oil and mining resource companies in UK in the last several weeks.

The uptrend line was broken last week and may pose a bit problem for the bulls. The medium downside target is 5625.

S&P500:

Big Picture: (monthly)... Potential major Turning Point this month to the downside..

Medium term (weekly): Sideways

Short term (daily): May have one more upside to test the resistance of May high

Weekly MACD: FTSE, Nikkei, ASX - DOWN (Bearish), SPX still UP (but watch closely as it has almost reached the May high (resistance) this year.

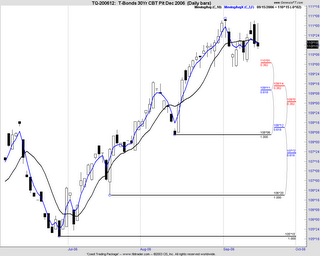

Commodities Corner: Treasury Bond, 30Yrs

Fundamental: (Source: CRB)

T-note prices remain near the top of the rally that has been driven by a weaker economy and a halt in the Fed’s tightening process. The recent plunge in oil prices is also bullish for T-note prices since the headline CPI inflation statistics will be able to ease in the next several months, although lower oil prices also mean a stronger economy and a somewhat greater threat

from core inflation. The market is almost unanimously expecting the FOMC at its meeting on Sep 20 to leave the funds rate target unchanged at 5.25%. The minutes from the last FOMC meeting on Aug 8, when the Fed halted its 2-year tightening regime, showed that all the FOMC members except one (Lacker) were on board for the pause.

Technical:

Weakness in Tbond is seen on the daily and weekly, high possibility of reversal in the coming weeks...

Trading ideas : (please apply your risk management rules in all trades)

Writing Options: Coffee OTM Calls

Futures: Long Sugar, Short 5 Year Tnote/ Tbond, Long USD Index

Stock Options: AMD (long puts), GM (long puts)