Week of July 16th: Seasonals and S&P's Possible Support

Click to enlarge

Seasonals: what is it ?

Seasonality may be defined as a market’s natural cycle, an established tendency for prices to move in the same direction at a similar time every year. Annual cycles of demand and supply give rise to seasonal price phenomena especially for commodities like grains and energy, etc.

i. Dow Jones (DJIA):

The above seasonal chart for Dow does not look good at all in July, starts declining sharply in mid July before rebounding into Aug. Note that seasonal charts does not tell us how many points would the index drop but it just shows the strength of the pursuing trend at any time of the year. Mathematicaly, it is just a point estimate at any give time over 5 years, 15 years, or 20 years if data is avaialble.

ii. Nikkei

Similar to Dow, sharp decline is expected in July, showing intermediate bottom in early Aug.

I hope the readers new to seasonal topic have learnt some of the important factors affecting markets....!

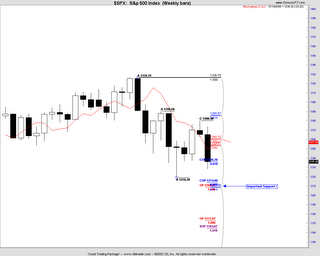

iii. S&P500 (Where would it go next, i mean the support ??)

The last chart Weekly SPX cash index, shows some key possible support at 1210, about 25 points away from where it closed last friday at 1236. Further down the path is 1162.

I would anticpiate some "wash and rinse" at 1210....ie stops placed below 1219 are "cleaned up" before having some short term rebounce and then move towards 1162.

With the additional seasonal influence and the current negative political climate around the world, these levels are not impossible to reach...

Big Picture: Long Term has not changed (monthly)... Bearish....

Medium term: Weekly, bearish ...

Short term: Some short term rebouce possible in early of the week to clear some oversold levels before continuing the downtrend this coming week, in sync with the medium and long term downtrend

Technicals: FTSE, Nikkei, ASX, S&P's Weekly MACD Histogram (WMH) - DOWN (bearish)

Trading ideas :(please apply your risk management rules in all trades)

Rolling Options: Sell OTM calls on S&P, Sell OTM puts on Cocoa..

Futures: Long Rough Rice

Stocks Options: AES (long calls), CMCA (long puts)

Good trading !