Week of Nov 19th, S&P 500 and Corn

Click to enlarge

Stock Index Corner: S&P 500

The weekly of S&P has formed a higher low and turned bullish and now possibly moving towards 1424 as the next target.

S&P500:

Big Picture: (monthly): Bullish

Medium term (weekly): Bullish

Short term (daily): Bullish

Fundamental:

The S&P 500 forward P/E (based on forward-looking earnings) is currently at 15.94 which is

moderately above the recent 11-year low of 14.27 posted in mid-June but still keeps the stock market in a fairly reasonable valuation light.

Major World Indexes

Weekly MACD Histogram (Medium term): FTSE, NikkeiASX - Down

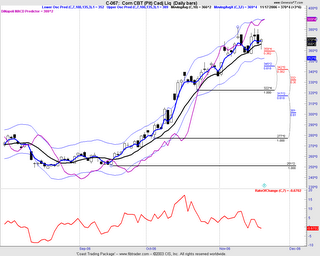

Commodity Corner: Corn

Technical:

Corn is the most bullish grain commodity and has risen more than 50% in the last 2 months. The daily is showing some tehnical weakness and may decline to 345 for Dec futures.

Fundamental:

The USDA report on Nov 9 failed to give the market any fresh bullish impetus and the market

is now being weighed down by harvest pressure and long liquidation pressure by large specs. Since this year’s corn crop is nearly in the bin (90% harvested) and weather has ceased to be a factor, the question is whether there will be enough corn from this year’s crop to meet strong usage demand. So far, export demand has been holding up despite high prices, which means that prices will need to remain high enough to draw out 53% of the corn in inventories. Thus, even if corn prices fall on some long liquidation pressure, the decline is not likely to go very far due to the tight supply situation for this year and next year.

Trading ideas : (please do your own research and apply your profit/ risk management rules in all trades, please note except options writing, all the other trades may last just several days)

Writing Options: Naural Gas OTM Puts

Futures: Short Cotton

Stock Options: Long Apple Calls, Long Orcl calls