Week of Aug 27th, S&P and Sugar

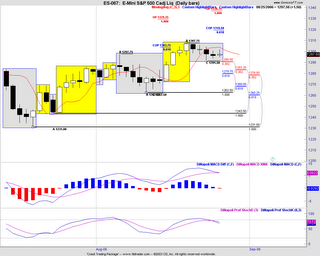

Click to enlarge:

Stock Index Corner:

S&P500: S&P stock index is still in a bull trend, indicated by both the weekly MACD Hist. The corrections in the last few days after hitting COP 1303 level have not created any significant change in the medium term trend. The strong support is at abt 1280 level (Sep Futures).

Next target is 1319 (Sep Futures) if it stays above 1280 this coming week.

Nasdaq has been outperforming the S&P for the last 2-3 weeks in percentage gains. This may help the broadmarket sustain the current level for at least a sideway to bullish bias trend.

Fundamentals:

Q2 earnings season is now virtually complete with only a few S&P 500 companies left to report. Earnings expectations in the latest week were little changed for Q2 (+16.3%), Q3 (+14.9%), Q4

(+14.6% ), and Q1-2007 (+10.5%), according to Thomson First Call. Expectations for 2006 earnings growth of +14.9% would mark the 4th consecutive year of double-digit earnings growth (2005 +13.7%, 2004 +20.2%, 2003 +18.4%, vs 2-decade avg of +7.5%). The S&P 500 forward P/E (based on forward-looking earnings) is currently at 14.86 which is just mildly above the recent 11-year low of 14.27 posted in mid-June and keeps the stock market in a reasonable valuation light.

Big Picture: Long Term has changed (monthly)... Bearish....(The May low is now the higher low on the monthly chart). The traditional seasonal weakness in September may not eventualise. The May/June corrections could have be the weakest trend of the year. We will see if this is true.

Medium term (weekly): Weekly Bullish

Short term (daily) : Daily - Sideways to bullish bias

Technicals: FTSE, SPX Nikkei, ASX Weekly MACD Histogram (WMH) - still UP (bullish)

Commodities Corner:

Sugar

It has trended down nicely since early July from 17.25 (S Oct), but prices stabilized in the past week following the sharp 2-month sell-off to an 8-month low. Bearish factors include long liquidation pressure, weakness in ethanol and crude oil prices, and Brazil’s incoming center-south cane harvest (which is nearly one-half complete). Longer-term fundamentals have turned slightly bearish since the market is now forecasting a small surplus for 2006-07 (Oct-Sep) after three straight years of deficits as production picks up in response to high prices.

Technicals: It has touched a significant 0.682 level support (12.20) and also the XOP of 11.94 (agreement). High chance that there will be a rebounce at that level.

Trading ideas :(please apply your risk management rules in all trades)

Writing Options: Cotton (OTM Puts)

Futures: Short Australian dollar, Long Sugar

Options: TLAB (long call), SNDK (Long call)

3 Comments:

Hi Frank

Enjoyed reading your blog. I am especially interested in options and would like to meet up with you at your convenience to explore some possiblities. Can you contact me at 97360090. Best regards,

Robert

Hi Frank,

I am very interested in knowing how you become a professional investor from a salary based employee. I hope to be a full time investor like you one day. Hope to hear your story.

Regards,

Alan

9663 3378

Hi Frank

I read about in the Sunday Times when working overseas 2 weeks ago.

I intend to start trading futures soon (history in stocks)and will now read your blog regularly.

Thanks

Chris

Post a Comment

<< Home